It’s really hard to buy a sports team in the NBA, NFL, or MLB. By really hard, I mean it costs over $2B. The most recent transactions have gone for:

- Denver Broncos, $4.7 billion (2022)

- New York Mets, $2.4 billion (2020)

- Carolina Panthers, $2.3 billion (2018)

- Brooklyn Nets, $2.4 billion (2019), with a recent minority sale bumping that valuation up to nearly $6 billion (2024)

- Houston Rockets, $2.2 billion (2017)

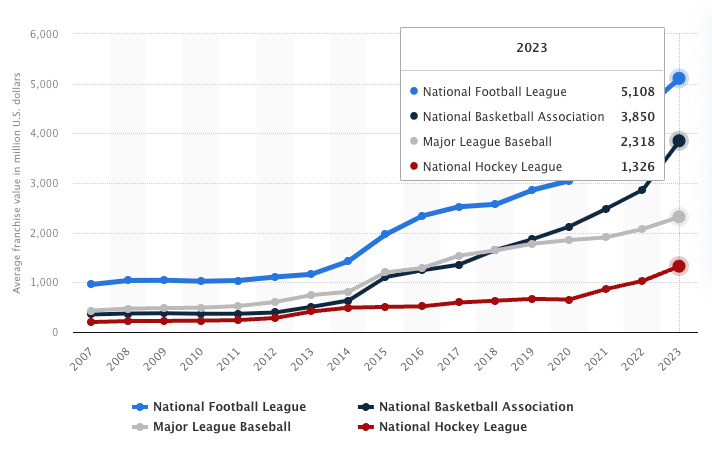

Now it’s a bit easier if you like Hockey as two recent transactions have gone for under a billion: Nashville Predators, $880 million (2023) and the Arizona Coyotes, $300 million (2019), yet the average NHL franchise value last year was still north of $1.3B.

demand for ownership

These sports teams aren’t getting cheaper. After becoming a billionaire, it seems many people enjoy adopting the moniker “team owner.” Either that, or they’re just willing to pay a lot of money for good seats and locker room access.

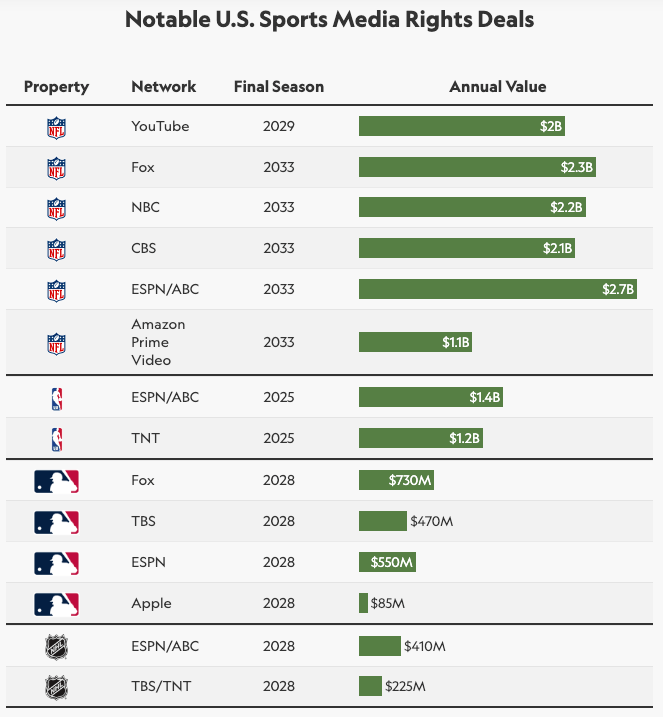

This trend of skyrocketing North American sports teams’ valuations—driven by increased interest, rising revenue from media deals, and the incredibly limited supply (one team changes hands every few years)—won’t be slowing down anytime soon. That’s because the owners have no incentive to add new teams. Sure, the pie might get marginally bigger in terms of fanbase and additional revenue, but the increase is so marginal relative to the potential revenue and the complexities, capital, and potential reputational damage make it unnecessary for the NFL, NBA, and MLB, which is why we haven’t seen a new team in any of those leagues for the past twenty years. 😱

Purchasing a sports team offers significant tax benefits, which owners leverage to their advantage. For example, from 2014 to 2018, Steve Ballmer reported $700 million in losses for the Clippers, primarily due to the depreciation of player contracts and other intangible assets. The current IRS rules legalized in 2004, allows owners to claim deductions over 15 years by treating player contracts as depreciable assets, thereby reducing taxable income while still benefiting from the team’s revenue.

Despite reported losses, the value of the Clippers franchise continued to rise, showing a disconnect between paper losses and actual financial health. This is similar to how depreciation works in other industries and is a major reason why people invest in real estate. I’m not against this rule; it’s just important to point as out as it’s a nice bonus for owning a team.

Before 2004, the 50/5 rule allowed owners to allocate up to 50% of the purchase price of a franchise to player contracts and depreciate that amount over five years, offering faster depreciation. Although the new 15-year rule spreads deductions over a longer period, it remains almost as beneficial, as player salaries typically make up over 50% of a team’s total costs.

impact of relocations

Since no new teams are getting created, we’ve seen relocations to more lucrative markets. The NFL’s Rams and Chargers moved to Los Angeles, while the Raiders relocated to Las Vegas, significantly boosting franchise values. For instance, the Rams’ value soared to $6.2+ billion post-move. Similarly, the NBA’s Nets saw their valuation rise to $3.5 billion after moving to Brooklyn. These shifts illustrate how teams capitalize on larger markets and state-of-the-art facilities to enhance revenue streams.

Now these moves certainly rattle fans and reshape cities, but it’s something that’s happened since the beginning of pro sports. In fact, since the 1949-1950 NBA merger of the Basketball Association of America (BAA) and the National Basketball League (NBL) only the Boston Celtics and New York Knicks have remained in their original cities out of the 17 original teams.

nhl and mls expansion

The NHL and MLS, which have revenues significantly lower than the MLB, NBA, and NFL, have still managed to expand. However, there seems to be a cap at around 32 teams in North America, plus an aggregate value of media deals they can expect to earn. Currently, the NHL has 32 teams and MLS has 29 teams, with plans for 30.

The NHL has expanded recently with the Vegas Golden Knights (2017), Seattle Kraken (2021), and Utah Hockey Club (2024). While over the past decade, the MLS has grown more rapidly, adding eight new teams. Its $2.5 billion media rights deal with Apple over ten years marks a 250% increase from its previous agreement. However, MLS still trails other major North American sports leagues in media revenue. The NHL’s deal with ESPN and Turner Sports is worth $4.37 billion (2021-2028), which is 2.5x more valuable per year. The Big Ten conference secured a $7 billion agreement with Fox, CBS, and NBC (2023-2030), averaging $1 billion annually.

emerging sports leagues

The limited number of teams in major North American sports leagues, combined with skyrocketing franchise values, is driving the growth of new sports leagues. These leagues are leveraging digital platforms, innovative formats, and shifting consumer preferences to carve out their own niches.

While major leagues remain unthreatened by emerging sports like pickleball or the rising popularity of lacrosse, similar to how the NFL was to baseball in the 1960s, the fixed number of team spots, new media distribution methods, and athlete platforms are spurring the growth of new leagues. These factors could make new leagues competitive in the coming decades.

Over the past decade, North America has seen the rise of at least a dozen innovative sports leagues, adding vibrancy and diversity to the sports landscape. These leagues are bringing fresh excitement and engagement to fans.

- Over $10M in funding

- At least 100 players

- Reputable backing (such as former professional athletes) and/or sponsorships

In alphabetical order (not in viewing preference):

- American Cornhole League (ACL): Founded in 2015, the league has grown significantly, securing major media partnerships with CBS Sports and ESPN, and is valued at over $10M.

- Athletes Unlimited: Founded in 2020, encompassing multiple sports such as Softball, Volleyball, and Basketball, with over $30M raised from investors like Andreessen Horowitz.

- Call of Duty League (CDL): Founded in 2020, with investment from Activision Blizzard.

- Drone Racing League (DRL): Founded in 2015, raised over $20M from investors like Lux Capital and celebrities like Matt Bellamy.

- eMLS: Major League Soccer’s esports league, founded in 2018, has received significant investment through MLS and sponsorship deals.

- Fan Controlled Football (FCF): Founded in 2017, this league raised over $15M from investors including Lightspeed Venture Partners and Animoca Brands.

- League of Legends Championship Series (LCS): Founded in 2013, with significant investment from Riot Games.

- Major League Rugby (MLR): Founded in 2017, this professional rugby union league raised over $10M.

- National Women’s Hockey League (NWHL): Founded in 2015, it raised over $10M through private investors and sponsorship deals.

- Overwatch League (OWL): Founded in 2017, also with significant investment from Activision Blizzard.

- Overtime Elite (OTE): Founded in 2021, this basketball league raised over $80M from investors like Jeff Bezos and Drake.

- Premier Lacrosse League (PLL): Founded in 2018, raised over $30 million from investors like The Raine Group and CAA. Utilizing a tour-based approach, the league brings all teams to different markets each weekend. This strategy optimizes venue usage and network programming windows, helping the sport gain visibility and popularity across the US before transitioning to a city-based model.

- The Snow League: Founded this year by Shaun White, it is the first professional winter sports league for snowboarding and freeskiing. It debuts 2025, providing athletes with opportunities to compete for the title of world champion.

Now some leagues I was suprised upon research are actually over a decade old, but are growing in popularity and still reflect an overall pattern of emerging leagues:

1. American Ultimate Disc League (AUDL): Founded in 2012, this league has expanded to 25 teams in the U.S. and Canada. It secured significant investment from Legends, a sports advisory company co-founded by the New York Yankees and Dallas Cowboys. The league also has media deals with Fox Sports and its own streaming service, AUDL.tv

2. Professional Bull Riders (PBR): Established in 1992, PBR hosts events featuring professional bull riding. It has grown significantly over the years and was acquired by WME-IMG in 2015.

3. Major Arena Soccer League (MASL): Launched in 2008, MASL is a professional indoor soccer league with teams across the U.S. and Mexico. The league has garnered investment and support from private investors and team owners to sustain its operations and growth.

With Name, Image, and Likeness (NIL) regulations revolutionizing college and, in some cases, high school sports, athletes are now getting paid. Nearly 30 college athletes are estimated to earn over $1 million annually in endorsements, blurring the lines between amateur and professional status. This shift might help other sports gain recognition if a star brings attention to them, much like Kaitlin Clark has done for the WNBA. If standout athletes emerge in sports like volleyball or water polo, their marketability alone could sustain a niche league that expands intelligently.

drive-to-survive-ification

Shaun White’s The Snow League is addressing a major gap in winter sports by creating a cohesive, league-style format for snowboarding. Years ago, White recognized a significant disconnect in the sport: despite his undefeated season in various competitions, he wasn’t crowned world champion. This highlighted the fragmented nature of events like the X Games, Dew Tour, and the Olympics, which exist independently without a unifying structure.

The Snow League aims to unify these events, allowing fans to follow storylines, support their favorite athletes, and understand the stakes of each competition. White’s vision is inspired by the success of existing leagues (duh!), but also by the successes of compelling narrative storylines like those told by Formula 1, a fairly technical, previously less accessible sport.

The Snow League will definiely focus on human interest stories, offering behind-the-scenes content that develops the characters of the sport. This approach helps fans form personal connections with athletes, understanding their lives, struggles, and triumphs. By creating a cohesive narrative, The Snow League aims to elevate snowboarding and freestyle skiing to new heights, providing a unified and engaging experience for fans and athletes alike.

“There will be component of storytelling in some way that goes beyond just the live broadcast, for sure” -Shawn White

Shaun White, a three-time Olympic gold medalist and 15-time X Games gold medalist, is uniquely positioned to launch The Snow League, encompassing both snowboarding and freestyle skiing. With his deep-rooted connections, unmatched legitimacy, and comprehensive expertise, White is the only one who could start a league of this caliber. His passion for these sports and desire to give back ensures that he’s focused on creating something new and impactful, rather than acquiring preexisting teams or media rights. White’s involvement promises to elevate snowboarding and freestyle skiing, engaging current fans while attracting a new audience, and making these sports more accessible and exciting for all.

keys to longevity

To be a successful league, I believe there are few criteria (in no particular order):

- Positive Television Viewing Experience: The sport must be engaging and entertaining to watch on television, with clear visuals, exciting gameplay, and effective broadcasting.

- Attracting Top Players: To be the best of its kind in the world, the sport must attract elite athletes, ensuring high-quality competition and increasing its appeal to fans. For example, Major League Soccer (MLS) will have a capped value unless it can rival European leagues in terms of player talent, which it’s getting continually better at.

- Pioneering Professional League: The sport should either be the first professional league of its kind (e.g., professional pickleball league or drone racing league) or offer a new format of an existing sport that showcases elite talent in a unique way (e.g., 3 vs. 3 basketball).

- Strong Digital Presence: Utilizing social media and digital platforms to engage with fans, provide interactive experiences, and enhance visibility. A robust online presence can help in building a dedicated fan base.

- Innovative and Flexible Business Model: The sport should employ flexible and innovative business strategies that adapt to changing market conditions and consumer preferences. This can include diverse revenue streams such as digital content subscriptions, exclusive streaming deals, and direct-to-consumer platforms.

- Community and Grassroots Support: Building a strong community and grassroots support through youth programs, local partnerships, community events, and social responsibility initiatives. This fosters loyalty and long-term engagement.

- Competitive and Strategic Balance: Ensuring a level of competitive balance that keeps the sport interesting and unpredictable, while also providing strategic depth that engages both casual viewers and hardcore fans.

Assuming the sport meets all of these criteria, a niche sports league can thrive in specific markets without global appeal, focusing on less saturated areas to build their brands effectively. New leagues often employ flexible, innovative business models that adapt to changing market conditions.

We may see new leagues emerge in sports popular among North American high schoolers and colleges, such as water polo, rowing, field hockey, or wrestling (not the WWE kind). These sports could establish professional leagues in the U.S., driven by athletes’ desire to play professionally in their home country while enjoying the social cachet and potential for alternative revenue streams through endorsements and micro-influencer deals.

From an ownership perspective, live sports remain a crucial media property. Building a brand with athlete-backed distribution and a content-first strategy can generate substantial revenue and interest. America’s abundance of large-capacity stadiums (over 400 with 10,000+ capacity), which is ~5x the amount of any other country, allows for building meaningful audiences and hosting live events with reduced risk. Starting a league early offers the opportunity to be a team owner, see investments grow, and potentially vertically integrate related products around the sport.

other considerations

While my focus has been on North American leagues, new global sports initiatives are also emerging. Cricket, arguably the world’s second most popular sport, exemplifies this trend with innovative formats like T20 attracting global audiences.

Additional factors reshaping the sports landscape include:

- Sports Gambling: Legalization driving new revenue streams and fan engagement.

- Fantasy Sports: Transforming fan interaction and creating business opportunities.

- Esports: Blurring lines between traditional sports and digital entertainment, attracting younger audiences (close to 300M of them!)

These trends are revolutionizing sports consumption, league creation, and revenue generation in the global sports ecosystem.

failures in new sports leagues

It’s not surprising that many have attempted to replicate the NFL’s $20 billion annual success. However, none have succeeded yet. The XFL, launched by Vince McMahon in 2001 and revived in 2020, faced financial losses and was ultimately derailed by the pandemic. Similarly, the Alliance of American Football (AAF), founded in 2018, folded after just eight weeks due to insufficient funding. The United Football League (UFL), which started in 2009, managed to operate for four seasons before succumbing to financial instability. These examples highlight the significant challenges of establishing new leagues amidst financial and operational hurdles.

These football offshoots do seem somewhat inevitable, and you can’t fault the attempts for trying. It’s no secret that football has led the sports world for 50 years and raked in enormous profits. Yet, it’s primarily an American sport and the season doesn’t even last half the year (25 weeks including pre-season to the Superbowl). Imagine if it expanded globally and occurred every week of the year!?

Well, the NFL thought this was a good idea when they backed the NFL Europe for 16 years (until it shut down in 2007) and experimented with rules like allowing a 4-point field goal for kicks over 50 yards. These other football leagues can serve as profitable proving grounds for talent and labs for experimentation. Plus, the NFL itself was born from a merger (the AFL and NFL merged in 1966), so it’s understandable that competitors do sprout up and have the potential merger/acquisition exit scenario.

Now back to the XFL…

In an ambitious move to overcome these obstacles, Dwayne “The Rock” Johnson, along with business partners Dany Garcia and RedBird Capital, acquired the XFL in 2020. Their vision is to relaunch the league as a sustainable and entertaining alternative to the NFL, leveraging Johnson’s star power, Garcia’s business acumen, and innovative partnerships.

However, the XFL faces challenges in attracting top-tier talent, as the best football players typically always aspire to play in the NFL, which offers higher salaries, greater prestige, and more comprehensive career opportunities. This remains a significant hurdle for the league’s long-term success.

Without top athletes, the quality of play in the XFL may seem inferior, hindering fan interest and media coverage; it will seem like a developmental league and career safety net. In contrast, derivative leagues in sports like basketball with different formats (e.g., 3 vs. 3) require unique skill sets and don’t face the same issue of lacking top talent (although many might still question its entertainment value).

new trends and future directions

As the sports landscape evolves, expect controversial shifts, such as the rising dominance of eSports, transformation of financial models, and the emergence of athlete influencers. Sustainability and social responsibility will also reshape the industry. These changes, though potentially resisted by traditionalists, represent the future of an industry driven by technology, shifting demographics, and evolving consumer preferences.

Each major sports league has implemented recent rule changes to enhance the fan experience, like the NFL’s shortened overtime, the NBA’s shot clock reset (14 seconds instead of 24 on an offensive rebound), the MLB pitch clock, NHL’s 3 vs. 3 overtime, and VAR technology in soccer. However, these changes sometimes conflict with player preferences, highlighting the challenge of balancing fan engagement with player welfare. Non-traditional sports and competitive activities are also rising, diversifying the sports landscape and creating opportunities for new leagues to thrive.

Events like Hyrox and ultra-endurance races are gaining popularity, while technological advancements in virtual and augmented reality are poised to revolutionize fan engagement. Sustainability is becoming key, as seen with Formula E’s growing global audience. These trends highlight the sports industry’s adaptability and potential for niche sports to thrive, creating a dynamic future for both traditional and emerging sports.

Globalization presents opportunities and challenges for new leagues. Targeting international markets, producing localized content, understanding cultural differences, and leveraging global stars are crucial strategies. The Ultimate Kho Kho league and Overtime Elite exemplify these approaches by expanding beyond their home markets and engaging international audiences.

Building a strong community and grassroots support is essential for new sports leagues. Youth programs, local partnerships, community events, and social responsibility initiatives foster loyalty and engagement. Major League Pickleball, the Premier Lacrosse League, and Athletes Unlimited are examples of leagues successfully integrating into communities and building strong fan bases.

The sports landscape will continue to evolve due to the influx of money, attention, and recent rule changes ensuring its sustained popularity. Adaptability is key, as leagues must balance innovation with maintaining the culture and zeitgeist that fans cherish. However, some trends must change: ticket prices and team ownership costs are prohibitively high, limiting access unless money is no object. Despite these challenges, sports remain a cultural cornerstone, akin to a religion for many. We will likely see new sports emerge and existing ones grow, with value continuing to accrue to these global brands. The passion for sports ensures that they will remain a significant and dynamic part of our lives.