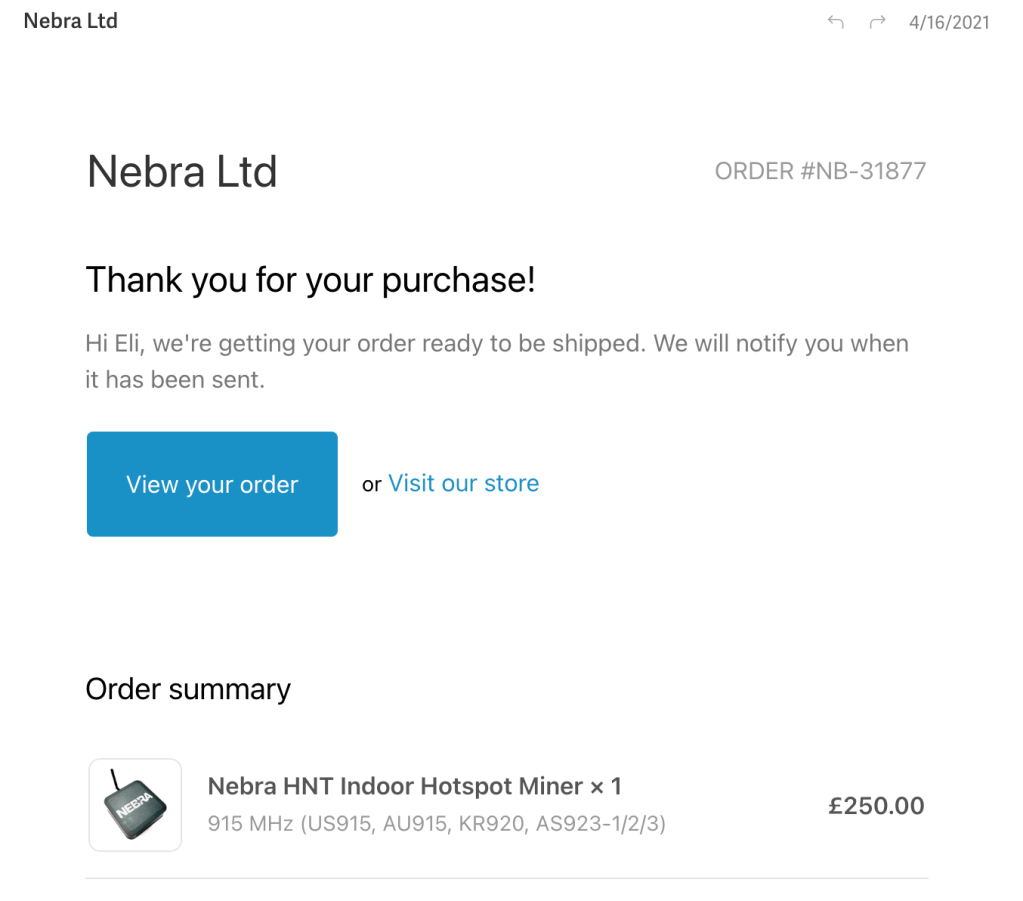

I ordered my two Helium Miners on April 16, 2021, when the $HNT token was trading at about $15, ~300% higher than it is today. I was one of many who have collectively spent over $500M on hotspots aka miners for the Helium Network.

wait, what is a helium miner?

Although it sounds like someone who might take a pickaxe to birthday balloons, it’s actually a key component of The Helium Network, founded in 2019, which aims to replace traditional cellular and Wi-Fi networks for IoT (Internet of Things) devices. It does this by providing a more cost-effective, scalable, and decentralized wireless infrastructure. People set up community-deployed hotspots aka miners (like the ones I purchased) and then receive rewards via blockchain technology aka the value layer of the internet. Then, Helium enables devices to connect to the internet over long distances with low power consumption, offering an alternative to expensive cellular data plans and limited-range Wi-Fi networks.

The Helium Network started as a blockchain-powered platform focused on IoT connectivity. It positioned itself as “decentralized,” though, like most crypto projects (aside from Bitcoin), it had a founding team, which challenges the pure definition of decentralization. The network used its native token, $HNT, to incentivize the deployment of hotspots, expanding network coverage and rewarding participants.

In 2022, the Helium Foundation introduced Helium Mobile as a separate initiative targeting decentralized 5G cellular connectivity. This led to the creation of a new token, $MOBILE, specifically for the Helium Mobile network. The split allowed each token to cater to its respective network—$HNT for IoT and $MOBILE for 5G—enabling a more tailored approach to incentivization and governance within the Helium ecosystem.

Helium’s US cell plan, which launced at the end of 2023, is $20. These hotspots, operated by individuals and businesses, earn $MOBILE tokens for their contributions, creating a robust and economically viable network for IoT applications.

embracing physical infrastructure and crypto

A few months after leaving ConsenSys, in Q2’2021, the intersection of physical infrastructure and crypto hit home for me. I didn’t receive either miner (one from Nebra and one from CalChip Connect) until after the token was on its descent from its $55 high, but I did realize that being able to boostrap a physical network is a compelling concept with a lot of potential applications.

Thankfully, I bought some $HNT to stay invested as I waited to join the network. I wish I’d purchased one when I first heard about it from Fred Wilson in his AVC newsletter on June 12, 2019, but then again, if I’d made smarter financial decisions about when I first heard about things like Bitcoin and Ripple in 2014, I’d have paid more money for a domain name or tried my hat at YouTube crypto-influencing (jk jk).

why do we need to replace cell networks?

In short, we don’t, but there is significant room for improvement in making them better, cheaper, and less reliant on centralized entities. Traditional cellular networks are costly to set up and maintain, often requiring extensive infrastructure and high operational costs. These networks are typically controlled by a few large corporations, leading to limited competition and higher prices for consumers. Helium wants to prevent this from also happening in IoT. Even if connectivity is much cheaper, but the majority is in the hands of one company aka Starlink, that can cause problems, which I don’t need to outline here.

This model reduces the need for expensive infrastructure and allows anyone to participate in building and maintaining the network. Individuals and businesses can set up hotspots and earn Helium Tokens ($MOBILE) as incentives, fostering a robust and economically viable network.

You can run a hotspot in your home/apartment and do the equvalent of bitcoin mining for network infrastructure (with much less expensive equipment).

iot necessetates inncreasing connectivity

Not only are IoT devices proliferating—there are currently around 16 billion devices globally, with this number expected to double in the next decade—but we are also becoming digital nodes ourselves. Remote work in the U.S. has surged from 3.4% pre-COVID to 59% by 2023.

So, if there’s more connectivity and more work from home, it makes sense that (1) we would want more nodes on the network, (2) there should be a way to compensate people for buying these miners and using their electricity, and (3) the network itself would become valuable because people and companies already pay for connectivity.

These three assumptions around network growth, incentivization, and real-world value are all critical when evaluating why DePIN projects exist and whether the’ll be successful.

why is DePIN important now and what’s exciting about it?

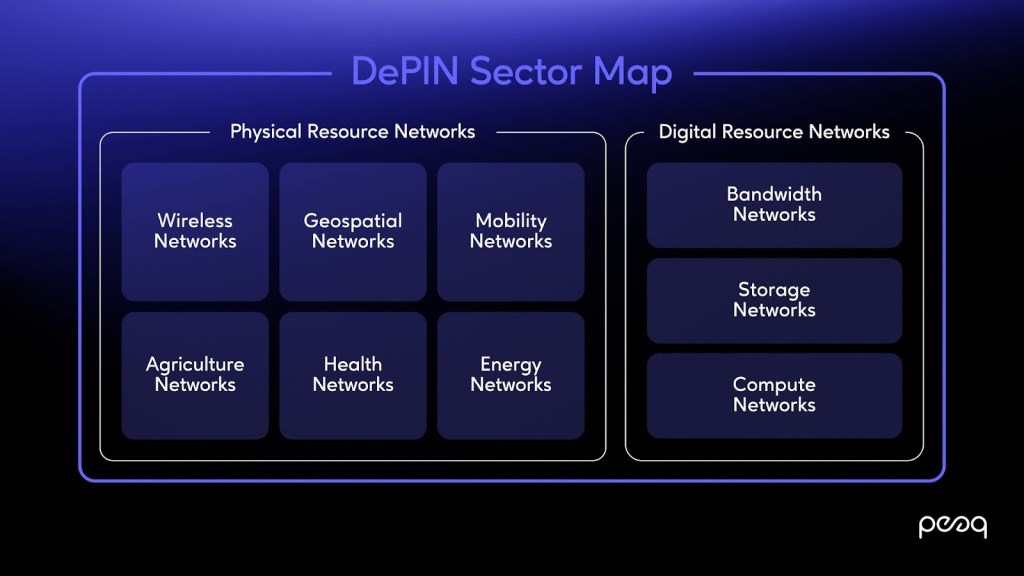

DePIN (Decentralized Physical Infrastructure Networks) is a decentralized model for building real-world infrastructure like mobility, electric vehicle charging, and telecoms using tokens to incentivize community participation. By coordinating capital, work, and incentives through blockchain, DePIN strives to guarantee trust and transparency without centralized control. Although the concept has existed since the late 2010s, the recent consensus around the term “DePIN” has unified the sector, marking a pivotal moment for Web3’s impact on physical infrastructure.

Tokens are the lifeblood of DePIN projects, serving as the incentive mechanism that drives network participation, from hardware maintenance to community evangelism. While an incredibly small percentage of the over 2M tracked on Coinmarketcap are useful, tokens are crucial for governance, providing “skin in the game” for participants.

DePIN, previously known as EdgeFi, Proof of Physical Work (PoPw), or Token Incentivized Physical Networks (TIPIN), has evolved significantly over the years. Helium, one of its pioneering projects, is now among 68 DePIN projects tracked by Messari. However, Helium has faced significant governance challenges, which plague many projects. These include issues with decentralization, voting participation, token distribution, and network congestion. Other concerns include spoofing (fake hotspots) and aligning token incentives with network goals. Reddit has plenty to say about this.

Helium and some other early DePIN projects can help us assess challenges and successes and consider its role in the upcoming AI boom and advancements in crypto infrastructure. One can imagine AI agents using crypto for decentralized transactions, automated payments via smart contracts, and international micropayments.

DePIN sectors

Physical resource networks have distinct incentives compared to digital ones. Signing a transaction and allocating compute or storage space on your computer (ex. Filecoin, Storj, Sia) by installing software or a browser extension is much easier than investing in the underlying data infrastrucutre or buying a hotspot/IoT device. However, both are vital elements of the broader DePIN sector and involve taking risks, whether in infrastructure or software, to join the network. Therefore, the rewards must be substantial enough to ensure participants aren’t just picking up sats in front of a steamroller.

Right now, DePIN projects have raised quite a bit of money and have an aggregate market value of $20B. Early-stage funding for DePIN projects has surged by 296%, this year to $250M, with DePIN platforms/Layer 1s (L1s) IoTeX and peaq leading major funding rounds in 2024. Both platforms claim to offer the super scalability, decentralization, and modular building blocks that DePIN projects need to build successfully.

Recently, DePIN gained more attention in the crypto community, fueled by discussions on spending for compute infrastructure, specifically AI. A clear economic model is crucial as it guides network value and modulates scarce resources more efficiently than traditional data centers.

As an aside, I don’t consider NFTs with a physical component or gamification element—like STEPN, or PuffPaw—as part of DePIN. These SocialFi or GameFi experiences, blending social interaction and finance, are NFT-enabled games where the physical item offers tangible value, creating a form of “physical play-to-earn.

early days

DePIN is still in its early stages, with the integration of IoT devices and wallets (since every machine will need a wallet to send and recieve payments) yet to fully materialize, primarily due to the lack of:

- Necessary enablement infrastructure like on-chain reputation systems to minimize some of the data or spoofing issues.

- Intuitive key management solutions to secure token incentives. Improving user experience is crucial because it strengthens security by making practices clear, intuitive, and easy to follow, addressing the common vulnerability of human error.

- More crypto users who genuinely, directly benefit from the infrastructure they’re supporting.

- Meaningful earnings for non-institutional players.

Whether lending unused internet to AI companies via platforms like Grass or installing DIMO in your car, the financial rewards are minimal. The abstraction of value through tokens in the crypto ecosystem can push users to take risks, like downloading vulnerable software or Chrome extensions, in pursuit of these low-value token rewards, as the detachment from real money makes them seem more appealing.

DePIN and AI

Crypto enthusiasts inherently distrust centralized power due to its potential for abuse, a concern that’s particularly relevant in AI, arguably the most transformative technology of our time. AI requires vast computing resources. While countries like China are making ambitious plans to boost their computing capacity by 50% over the next decade and a half by 2025! I don’t think many USA companies will be getting access to the additional 100 exaflops of computing power they’re bringing online (1 exaflop = the power of 2 million normal laptops).

Ensuring widespread access to GPU resources through DePINs is not just practical but ethically necessary. This approach democratizes AI development, allowing global researchers, startups, and innovators to access the computational power needed to advance AI technologies. By doing so, a more inclusive AI landscape emerges, fostering innovation and aligning with the concept of “Sovereign AI,” as coined by NVIDIA CEO Jensen Huang. This tries to make sure that nations can develop AI technologies that reflect and preserve their unique cultural identities.

The crypto community’s natural inclination towards decentralized solutions positions it to play a crucial role in the AI revolution. By integrating decentralized networks into AI infrastructure, we can mitigate the risks associated with centralization and create a more inclusive and ethical AI ecosystem. In essence, embracing decentralized networks is key to addressing AI’s ethical and resource challenges, ensuring that this transformative technology benefits everyone, not just a privileged few.

data ownership

However, I’m not arguing that “crypto solves an AI datacenter problem,” or ensures that AI gets rolled out effectively. In fact, there are quite a few considerations (including those that I mention in the section “early days”) that I don’t see getting solved in the short term (next 24 months).

AI has ignited new discussions about data ownership, particularly in how models are trained. DePINs tackle this by using blockchain technology and advanced encryption to secure data and define ownership clearly. This decentralized method enhances data protection, transparency, and accountability. While the technical details are complex and beyond my expertise, many believe it’s possible and are actively working on it. By giving data owners greater control, DePINs boost privacy and encourage data sharing, fostering the trust and collaboration vital for AI research. This approach aims to securely integrate diverse data sources, like healthcare records or private environmental sensors, without compromising privacy or ownership rights.

How valuable is this data? In most cases, I think way less valuable than the projects tout.

key risks: data quality

In all networks, bad actors are inevitable. So, how should builders handle data verification in DePIN projects? For projects focused on data collection—like Silencio Network, DIMO, and others—ensuring data quality is crucial to consistently rewarding users who share it. Relying on proprietary hardware isn’t the answer, as it introduces another point of centralization. However, the wide range of industries and device types involved makes implementing effective anti-spoofing measures a complex challenge.

To ensure data integrity in DePIN networks, a multi-layered approach is essential. First, storing private keys on devices allows them to sign data at the source, enabling traceability and filtering out malicious actors post-factum. However, for this to be effective, devices must be equipped with specialized software capable of signing transactions, though correctly signed data may still be incorrect. AI can be leveraged to detect abnormalities in the data, using the network effect to identify patterns and flag inconsistencies. Additionally, data oracles can serve as benchmarks, providing another layer of verification to further reduce the likelihood of malicious data being accepted. Other potential solutions include incorporating decentralized auditing systems and incentivizing community-based monitoring to enhance network security and data accuracy.

connecting to the physical world

The challenge with compute and tokenization lies in bridging the digital and physical realms—where digital compute power originates from physical machines. This issue parallels those faced by the real-world asset (RWA) blockchain community, which focuses on securing valid data without relying on a centralized party, while also establishing a real-world dispute mechanism that holds up in court.

“For Web3 to go mainstream, we need a connection between the digital and real worlds, which enable people to co-own assets that generate revenue based on actual services and goods.” – Leonard Dorloechter (Peaq, cofounder)

Tokenizing machine data and storing it on-chain, such as data from public EV charging stations, ensures secure, transparent, and immutable storage. This process not only opens new revenue streams for charging station owners but also enables widespread participation, allowing anyone—not just large corporations—to connect their devices and earn rewards. DePINs use blockchain technology to tokenize RWAs, bridging traditional asset markets with blockchain and democratizing investment opportunities. This approach empowers individuals to directly fund and earn from services they value, promoting inclusivity and passive income generation in the digital economy.

A tangible example of DePIN’s potential is the tokenization of a shared mobility fleet in Vienna. By bringing vehicle data on-chain, the shared mobility provider allowed users to invest in and earn rewards from the vehicle’s performance. This approach not only democratizes access to valuable assets but also improves operational efficiency and customer satisfaction, showcasing the practical benefits of integrating machine data into Web3.

Peaq’s ecosystem, which includes over 30 projects like noise pollution tracking, drive-to-earn navigation, and flight tracking, reflects this potential. However, decentralization challenges remain, as projects like Silencio and DIMO (built on Ethereum), founded in 2021 to create a decentralized ecosystem for car owners to monetize their vehicle data, still depend on mobile apps, making Apple and Google gatekeepers for access. This illustrates the ongoing challenge of balancing decentralization with the realities of existing tech infrastructure.

beyond tokenization

On-chain machine data significantly advances AI by supplying high-quality data for model training, driving improvements in predictive maintenance and performance optimization. Additionally, blockchain ensures data integrity and security, mitigating risks of manipulation and unauthorized access, particularly crucial in sensitive industries like healthcare and finance.

Projects like Silencio exemplify this by using over 150,000 noise pollution sensors in 170+ countries to collect and anonymize data on pervasive issues like noise pollution. This approach not only addresses public health concerns but also enables the collection of previously hard-to-gather data, expanding the potential for innovative solutions in various industries. But again, how valuable is this data and who is willing to pay for this? It’s not the high-fidelity voice data that Siri developers will pay for or LLMs need for training data.

why i’m skeptical

- Transitioning to a fully integrated Web3 ecosystem presents challenges, particularly in developing infrastructure that ensures secure and efficient data transfer.

- These challenges necessitate advancements in blockchain technology and the underlying hardware that supports it.

- Significant investment is happening in the sector, but gaps remain in coverage, cost, and usability.

- Incentives tied to performance are essential, but difficult to implement with crypto tokens due to rapid wealth accumulation by early participants.

- It’s not practical yet. Users will likely not engage with services consistently like noise data collection for minimal financial gain, similar to how many reject ads on mobile phones.

- Crowdsourcing mapping is valuable, but volunteer-driven initiatives (think Wikipedia) might be more sustainable than financial incentives with low hourly rates.

- Potential benefits include engaging younger or under-employed individuals and assisting foreign economies, but meaningful impact is likely years away.

- Zero-Knowledge Proofs (ZKP) will be crucial for M2M (Machine-to-Machine) commerce, but broader AI growth and community-driven developments are still in early stages and might take years to mature.

zero-knowledge proofs (zkp)

Zero-Knowledge Proofs (ZKPs) are critical for ensuring data privacy, security, and integrity within Decentralized Physical Infrastructure Networks (DePINs). ZKPs allow data to be verified without revealing the underlying information, making them ideal for sensitive applications like healthcare or finance. By enabling local proof generation on devices, ZKPs prevent centralization and maintain the decentralized ethos crucial for DePINs. This approach addresses traditional verification challenges that rely on costly and inefficient validators, which can slow down operations and compromise privacy.

Furthermore, the focus on scaling Ethereum has often overlooked the importance of memory-efficient ZKPs, which are essential for decentralized applications in constrained environments. Centralized proof generation undermines the core principles of DePINs, making local proof generation not just beneficial but necessary for true decentralization. As DePINs continue to grow, integrating ZKPs will be vital for providing reliable, efficient, and decentralized services, ensuring user privacy and supporting a more inclusive and equitable AI landscape. This integration fosters diverse perspectives in AI development, ultimately benefiting the broader ecosystem.

looking ahead

The long-term potential of decentralized infrastructure networks is undeniable, but significant hurdles remain before we see widespread adoption. Key technological advancements, such as Zero-Knowledge Proofs (ZKPs), are critical for ensuring privacy and trust within these decentralized systems.

The business value of these networks must be clearly demonstrated to attract meaningful investment and participation. Until these key components are fully developed and understood, adoption will likely remain slow. While I firmly believe in the medium to long-term potential of decentralized infrastructure, I’m skeptical that siloed crypto networks are the solution (silo means that every project has their own token). The technology is often specialized, concentrated in the hands of a few providers, or so technical that only a small group will engage, not to mention that the dollar values are often too low to justify the effort. It’s like why a Rolls-Royce owner doesn’t rent it out on Turo—the potential earnings aren’t worth it when they don’t need the money. So, the immediate future will likely focus on building the necessary foundations rather than achieving widespread adoption. Despite a few Coindesk headlines, the real momentum is still on the horizon.